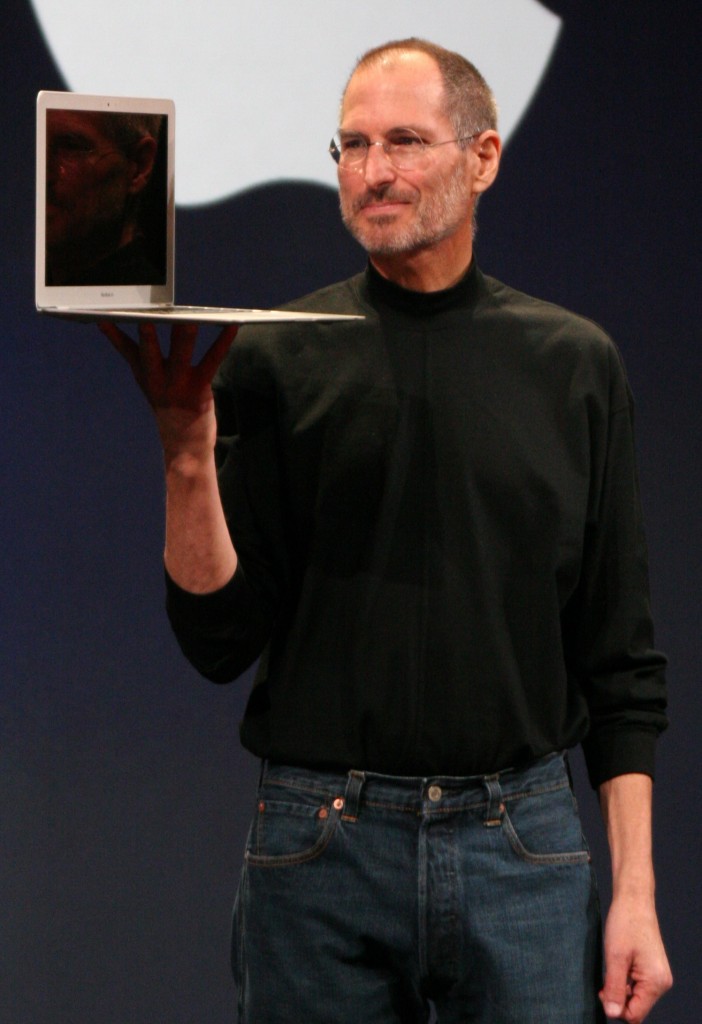

Steve Jobs never dressed like a typical CEO. He looked more like a bus driver than the head of a giant corporation.

PERSONAL TOUCH REPLACED

BY PENNY-PINCH MENTALITY,

COST-SAVING TECHNOLOGY

Unhappy, stressed out bank president

opts to become a carefree bus driver

By David Maril

Saturday a Bloomberg News story appeared in the Baltimore Sun alleging that Bank of America had been rewarding employees with bonuses for meeting mortgage quotas on foreclosures, steering customers into losing their homes instead of helping them apply for U.S. loan assistance.

According to statements from former Bank of America employees filed in federal court in Boston, they were awarded $500 bonuses and given gift cards for putting at least 10 customers into foreclosure.

If this proves to be true, so much for friendly neighborhood banking. But is this type of policy so hard to believe?

Have you recently tried to conduct banking business with a familiar customer service representative?

Impossible.

Personnel are shifted around from branch to branch. It’s amazing employees can keep track of where they are supposed to report to work each day.

The ultimate goal is to eliminate jobs and train all of us to do all banking either online or on ATM machines.

Every time I go into a bank, stand in line and make a deposit, the teller gives me a lecture on how I can save time and make the transaction outside of the bank at an ATM machine.

I reply that if people like me start doing that, people like her, or him, will be out of a job.

This type of corporate downsizing has been going on for years.

During a trip this April I was talking to a bus driver on a shuttle out of Logan Airport in Boston and he was telling me he’d been a president at two banks on Cape Cod but had walked away from the business 10 years ago.

‘COULDN’T STAND IT’

“I couldn’t stand it,” he explained. “I went through two mergers and they would bring in executives from outside of the area who didn’t know our customers and it became impossible to do local banking anymore the right way.”

He has had no regrets.

”I’m out driving around in the fresh air and not being told to do things I know aren’t right,” he said.

“Soon after I left the bank, I had a guy come up the steps on my bus, recognize me and comment that I had fallen pretty low, going from bank executive to a bus driver. I laughed and replied I couldn’t have fallen that low if he had to climb up three steps in the bus to be on the same level I was sitting.”

The practice of removing people from businesses doesn’t start or end in banks.

Good luck trying to connect with a live, customer service person in under 10 minutes when you call your cellphone provider.

Shop in most supermarkets throughout the Baltimore area and you’ll often find only one checkout lane staffed by a cashier. Stores are determined to train all of us to check-out and bag our own groceries. Even though they are eliminating jobs this way they don’t even offer us a discount if we do the work ourselves.

FOCUS ON THE BOTTOM LINE

These days the focus is on the bottom line and short-term saving instead of concentrating on building a team atmosphere with productive workers who believe in and contribute to product quality and customer service.

A friend of mine — we’ll call him Harry — used to run a business, employing around 100 full-time workers. He was an unorthodox CEO. His shirttail, under whatever bright, gaudy sports coat he chose to wear, was often out. His hair was a mess.

Despite being 30-40 pounds overweight and in his late 50s, he could often be seen running to his car or huffing and puffing through the hallways, late for a meeting.

Often he’d leave work and return in Bermuda shorts, to spend hours planting flowers, cutting the grass, and doing odd jobs around the building and its grounds.

Many workers still chuckle about the time he chased a field mouse up one of the halls, trying to catch it.

Yet, when it came to business and people, Harry was an extremely effective company manager. He was active in the community — serving on numerous local boards — and he understood every aspect of his business customer base.

Even though salaries were below market level, employees tended to stay for years because there was a feeling of security and freedom. People knew if they did their work, they would be left alone. Harry was always approachable. If anyone had a suggestion, he would listen.

GRATEFUL FOR WHAT HARRY DID

One long-time former middle-management employee will be forever grateful for what Harry did when he tore his Achilles tendon. Harry sized up the situation and explained to the guy — who was unable to drive his five-speed stick shift car — he’d arrange with a local auto dealer to let him have free use of a car with automatic transmission while he was wearing a cast.

When the employee kept thanking him, Harry shrugged it off by saying, “Look, it’s better for us to have you in here working instead of trying to replace what you do for a couple of months.”

It sounded reasonable but the guy also knew Harry was a loyal and considerate boss. And that compassion showed when one day he called a company meeting and started crying as he announced the business was for sale.

A large, national corporation bought the company. Within a year numerous firings and layoffs were carried out. Harry, forced to follow the rigid guidelines of the new ownership, unfamiliar with the local market, spent much of his time driving all over New England attending company meetings and conferences.

“This is a whole different world,” he sadly confided to a few of his friends. “All they talk about are monthly profit quotas and how much the business is making today. There’s no concern for the long-term. At one meeting I said we were going to go through a tough period but if we held our ground and geared up for the next season, we’d be in good shape. They almost fired me on the spot, saying I was ‘negative.’”

The business was sold a second time. Harry has now retired and the company is close to folding.

How many other “Harrys” are out there in the business world being driven out by the shallow thinking and greed of corporate leaders who don’t care about the local community or employees?

You have to believe consumer confidence would be restored if all the Harrys of the business world were allowed to emphasize product quality, long-term planning and pride in work.

davidmaril@hermanmaril.com

CHECK OUT LAST WEEK’S “INSIDE PITCH” COLUMN: click here

June 18th, 2013 - 11:15 PM

I prefer to be a member of a credit union, which is non-profit, instead of being a victim of the banks. People are leaving banks in droves because they’re tired of being used and abused by banks.

June 23rd, 2013 - 6:27 PM

[…] the Take Your Dog to Work Day Song. CHECK OUT LAST WEEK’S “INSIDE PITCH” COLUMN: click here …and read previous Dave Maril columns by clicking here. Filed under: Top Stories […]

August 26th, 2015 - 4:24 PM

[…] INSIDE PITCH — Short-term thinking replaces quality, long-term planning in contemporary business c… – The ultimate goal is to eliminate jobs and train all of us to do all banking either online or on ATM machines. Every time I go into … meeting and started crying as he announced the business was for sale. A large, national corporation bought the company. […]